CLIMATE CHANGE

Formulating Strategies, Continuous Monitoring and Implementing Improvements

We keep a close eye on global climate trends and international responses and include climate change as one of the material issues and risks in relation to corporate sustainability. Ongoing analysis and control are underway to mitigate and adapt to greenhouse gas emissions.

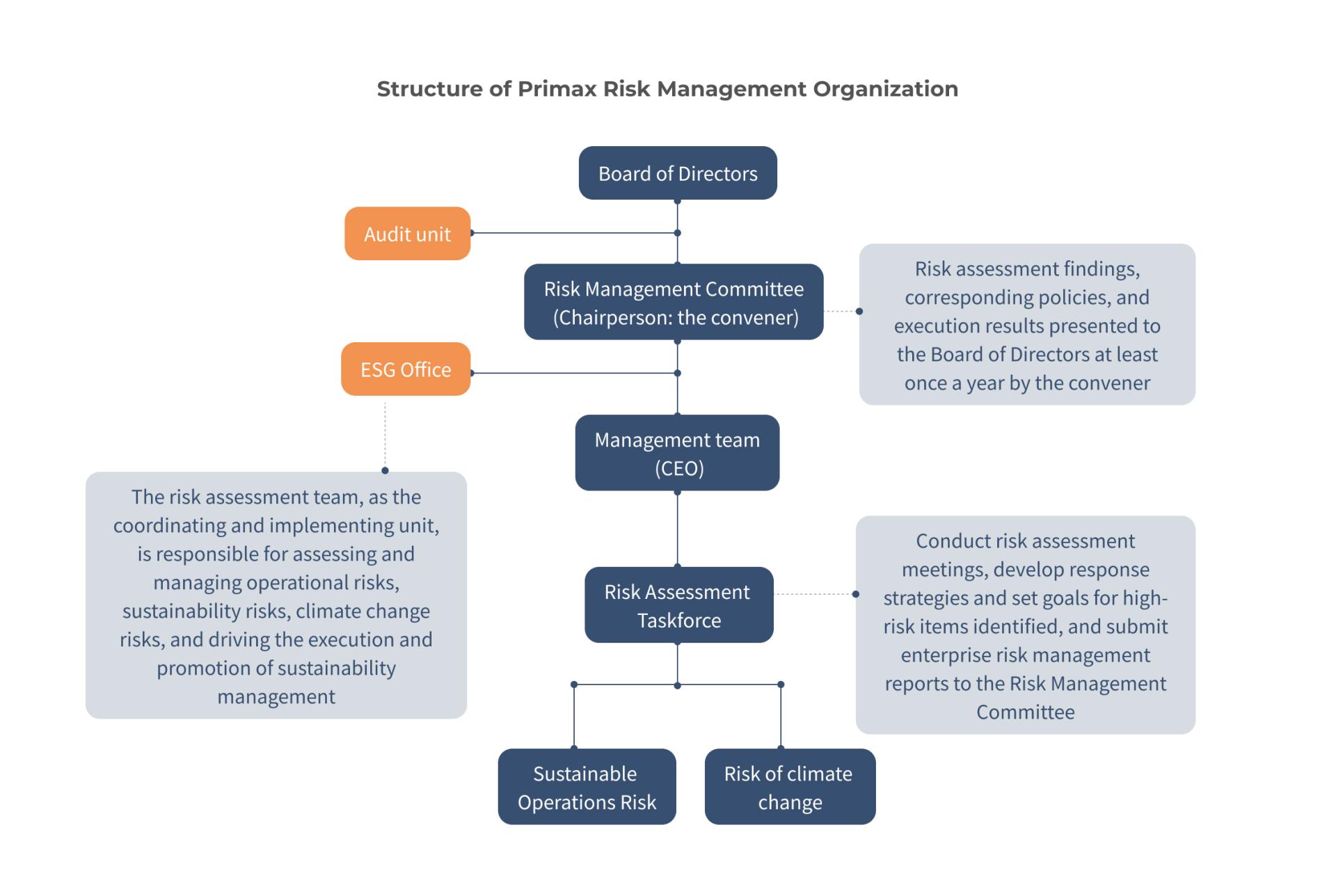

Establishing a Risk Management Committee to Regularly Review The Results

ESG Office is responsible for the assessment and management of climate risks. The Risk Assessment Task force by pulling together different functions. Risk and opportunity identification in relation to climate change is performed at least once per annum. The purpose is to evaluate and manage financial impacts, formulate responding strategies and define the targets of relevant items. Implementation results are reported to the Board of Directors each year.

Responsibility of the Board of Directors

- The Board of Directors provides guidance and reviews climate change risks and opportunities, assesses results, responds to strategies, and evaluates management performances. Measures are taken, and ongoing monitoring is conducted on high-risk items.

Encourage Green Production

- In order to realize green production, we have put in place for all our employees “Management and Control Regulations on Energy Efficiency and Waste Reduction”. This includes proposals for energy efficiency and carbon reduction. The proposers will be rewarded with merit points based on project effects. Year-end performance bonuses will be issued according to the Regulations.

Compensation Linked to Sustainability

- Starting from 2023 , senior executives at the level of Vice General Manager and above will have their compensation linked to sustainability performance, with a variation of 10-15 %. This linkage includes targets such as smart manufacturing and greenhouse gas reduction.

Process for Identifying Climate Change-Related Risks and Opportunities

The ESG Office focuses on researching and evaluating domestic and international regulations and initiatives related to climate change. This effort aids in the company's formulation of environmental policies, ensuring alignment with national developmental trends and enhancing Primax's capacity to respond to the challenges of climate change.

STEP

01

Process for Identifying Climate Change-Related Risks and Opportunities

STEP

02

Collecting Potential Risk / Opportunity Issues

STEP

03

TCFD Risk / Opportunity Assessment

STEP

04

Identifying Highly Correlated Risks / Opportunities

STEP

05

Strategy Discussion and Financial Impact Calculation

STEP

06

Goal Setting and Result Tracking

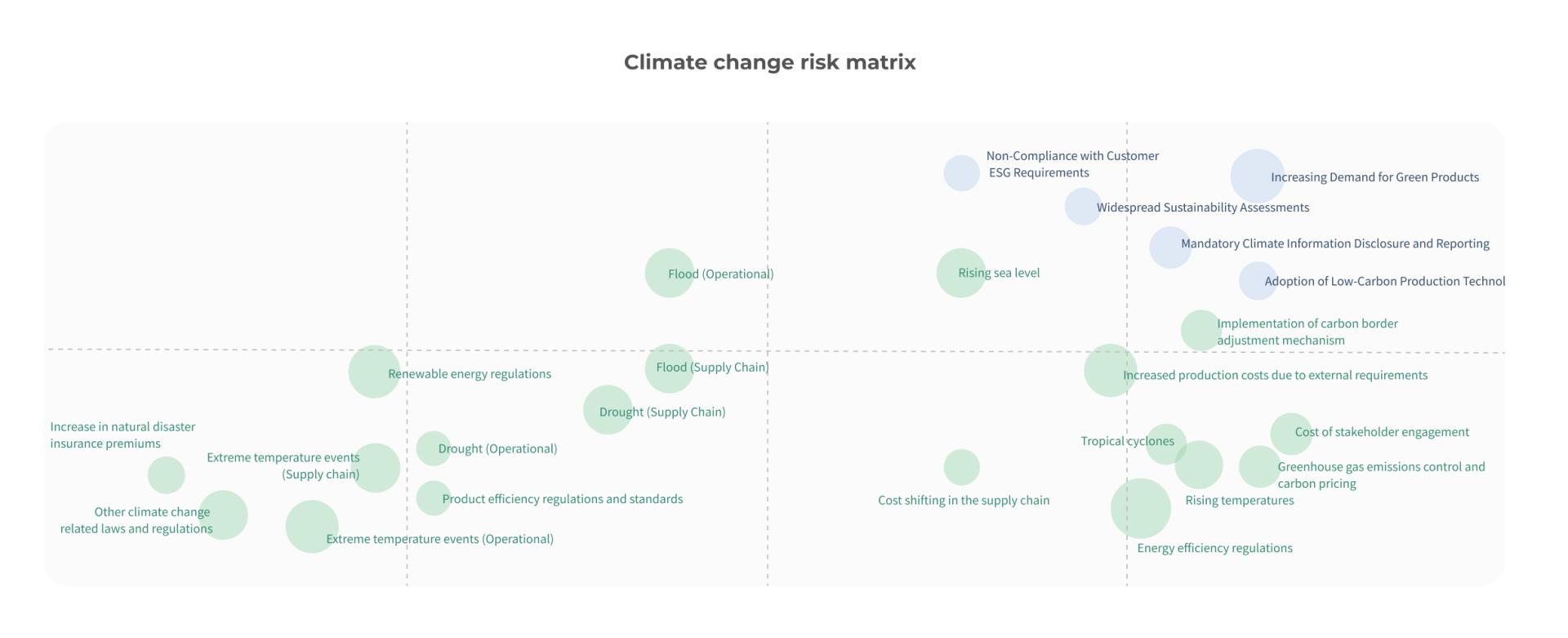

Climate Change Risk Matrix

- The risk assessment team, based on the questionnaire scales, considers international trends, existing company measures, and scenario simulation results to score and evaluate the risks. The results based on the scoring and identifies five climate change risks and three climate change opportunities, determine the future climate change related measures for the company.

- Based on the assessment results and the anticipated timeline for risks opportunities, the risk matrix is depicted as follows:

Develop Risk Mitigation Plans, Monitoring and Improvement

We follows the risk response steps outlined in the "Corporate Risk Management Policy and Procedures." For high-risk or necessary reporting items, we develop risk mitigation plans and ensure ongoing monitoring and improvement. The execution of significant plans is regularly audited by the audit unit, as part of our audit plan.

Risk

- Climate information disclosure and reporting

- Non-compliance with customer ESG requirements

- Widespread sustainability assessments

- Adoption of low-carbon technologies

- Increasing demand for green products

Opportunities

- Entry into new markets

Financial Impact Assessment of Climate-Related Risks and Opportunities

For the identified risk opportunity items, their corresponding strategies, actions, and expected output benefits are quantified as financial information.

The Analysis of Their Impact on Revenue Composition

- The financial impact is estimated to be approximately

Short Term (2023-2024)

12.41

%

Medium Term (2025-2027)

19.13

%

Long Term (2028-2032)

21.02

%

For comprehensive information regarding Primax's climate change risk, please refer to:《2022 TCFD Climate-related Financial Disclosures Report for complete information on Primax’s climate change risks.》For information and outcomes related to climate change adaptation and management, please refer to: Chapter 4 Environmental Sustainability.